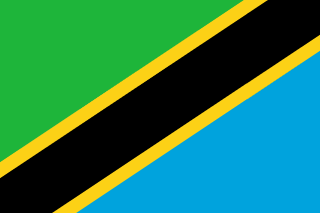

Importing Used Cars from

Japan

to

Tanzania

Regulations and Procedures

Introduction:

Importing used cars from Japan to Tanzania has become increasingly popular due to the availability of high-quality vehicles at affordable prices. However, it is essential to understand the regulations and procedures involved in the importation process to ensure a smooth and hassle-free experience. This article will provide comprehensive information on the factors to consider, importation process, age restrictions, import duties and taxes, required documentation, shipping and customs clearance, compliance and modifications, registration, as well as tips for a hassle-free importing experience. By following these guidelines, individuals can successfully import cars from Japan to Tanzania while staying compliant with the relevant regulations and requirements.

Factors to Consider When Importing a Car from Japan to Tanzania:

There are several factors to consider. These include the popularity of certain car models, such as the Toyota Land Cruiser Prado, Mitsubishi Canter, Toyota Harrier, Toyota Rav4, Toyota Coaster, Mitsubishi Fuso Fighter, Mitsubishi Rosa, Toyota Ist, and Toyota Corona Premio, which have been frequently imported between 2010-2020. Additionally, the importation process, age restrictions, import duties and taxes, required documentation, shipping and customs clearance, compliance and modifications, and registration are crucial aspects to understand and comply with.

The Importation Process:

The importation process involves several steps to ensure a legal and smooth transaction. Before importing a car from Japan to Tanzania, it is necessary to pass the JAAI (Japan Auto Appraisal Institute) inspection. This inspection ensures that the vehicle is roadworthy and meets the required standards.

Age Restriction and Vehicle Eligibility:

Tanzania does not impose a specific age restriction on imported used cars from Japan. However, vehicles older than 8 years are subject to additional excise duty. Age restriction recently changed from 10 years to 8 years as of July 1st.

Import Duties and Taxes:

Import duties and taxes are significant considerations when importing a car from Japan to Tanzania. Taxation is based on the engine capacity of the vehicle. Import duties and VAT (Value Added Tax) are applied cumulatively, while excise duty is charged based on the vehicle's cylinder capacity. The import duty and VAT percentages differ depending on the engine capacity and range from 0% to 10%. Excise duty rates also vary based on the cylinder capacity of the vehicle.

Required Documentation and Fees:

To import a car from Japan to Tanzania, specific documentation is necessary. These include the bill of lading, export certificate, proforma invoice, JEVIC or QISJ , agent's authorization letter, and import permits. It is crucial to gather and submit all the required documents accurately and promptly. Importation fees include value-added tax (VAT), import duty, and other applicable charges.

Shipping and Customs Clearance:

Shipping the imported car from Japan to Tanzania requires careful planning and coordination. Choosing a reputable shipping service that operates through the strategically-located port of Dar Es Salaam. Customs clearance procedures must be followed, including presenting the necessary shipping documents and JAAI certificate for inspection

Compliance and Modifications:

Complying with Tanzanian regulations and standards is crucial when importing a car from Japan. The imported vehicle must meet the required specifications and safety standards. Modifications may be necessary to ensure compliance, and it is advisable to consult with a professional or authorized service center for guidance.

Registration in Tanzania:

Upon arrival in Tanzania, the imported car must go through the registration process. This involves submitting the required documents, paying the necessary fees, and complying with the local registration procedures. It is important to follow the registration guidelines to ensure legal ownership and roadworthiness of the vehicle.

Tips for a Hassle-free Importing Experience:

To ensure a hassle-free importing experience, consider the following tips:

Conduct thorough research on the import regulations, taxes, and duties applicable to used cars from Japan to Tanzania.

Stay updated on any changes in local tax regulations by contacting the local authorities or customs offices.

Consider clearing and forwarding fees when estimating the total cost of importing the vehicle.

Verify the reputation and credibility of the exporter or shipping service by checking reviews and testimonials from previous customers.

Conclusion:

Importing a car from Japan to Tanzania requires careful consideration of various factors, including regulations, taxes, import duties, documentation, and compliance requirements. By following the prescribed procedures and adhering to the relevant regulations, individuals can successfully import used cars from Japan to Tanzania. It is essential to conduct thorough research, seek assistance from reputable exporters or shipping services, and stay informed about the latest tax regulations. With proper planning and adherence to the guidelines, importing a car from Japan to Tanzania can be a rewarding and cost-effective option for buyers.

Disclaimer: Regulations are subject to change. The information provided is for reference only. Consult a domestic customs broker for the most current and accurate information before importing a vehicle.